Does Private Health Insurance Help with Dental Bills

Having dental health insurance when it comes to dealing with dental care is one of the best options to help deal with any unexpected dental costs.

You need to work out what the right dental coverage is for you – for your needs, and for your family.

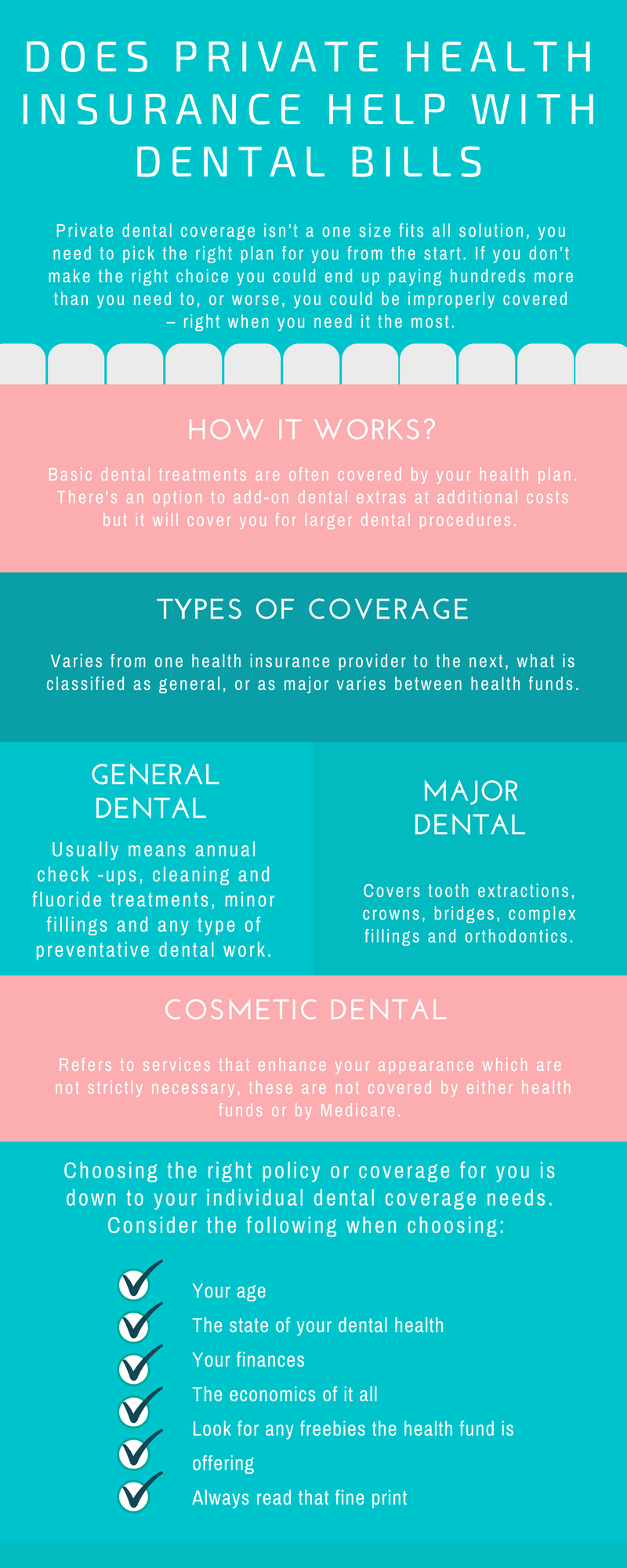

As with pretty much everything else private dental coverage isn’t a *one size fits all* solution, you need to pick the right plan for you from the start. If you don’t make the right choice you could end up paying hundreds more than you need to, or worse, you could be improperly covered – right when you need it the most.

Today there are just so many plans to choose from with so many different options – and a lot of *fine print* thrown in as well.

Let’s take a closer look –

- How it works – you won’t be looking for just *dental cover* it will be a part of your whole healthcare package. Basic dental treatments – regular check-ups, cleaning etc. are often covered by your health plan anyway. You will have the option to *add-on* dental extras – you will pay more for the *add-on* (but it will cover you for larger dental procedures). It’s a good idea to review your coverage from time to time so you know it’s still meeting your healthcare needs.

- Types of coverage and what’s best for you – typically dental coverage is available in one of two ways – general dental and major dental. It varies from one health insurance provider to the next, what is classified as general, or as major varies between health funds. General Dental usually means annual check -ups, cleaning and fluoride treatments, minor fillings and any type of preventative dental work. As the name suggests – Major Dental covers tooth extractions, crowns, bridges, complex fillings and orthodontics. *Cosmetic dental* refers to services that enhance your appearance – dental implants, tooth whitening etc. which are not strictly necessary, these are not covered by either health funds or by Medicare.

Lots of health funds offer basic levels of cover as standard – additional cover is available as an *extra*. Typically, basic extra’s cover general dental procedures only, while *additional extras* when offered, usually include treatments under both the dental and basic dental care categories.

Read Also: How to Find a Good Dentist

Should you use a health fund that covers general – or look for a plan that includes general cover + extra cover (for major dental work)?

Choosing the right policy or coverage for you is down to your individual dental coverage needs. For example

Young individuals or couples who have good general health might prefer general coverage, while a family or older people may prefer a plan that provides them with major dental coverage.

If you are young and your teeth are in good oral health there is no need to spend money on a plan that covers you for major dental work. A basic plan that covers you for general dental should be enough, just make sure you use any discounts on preventative dental benefits to keep your teeth in tip top shape.

If you think you may need an expensive procedure at some point in the future then a higher level of cover will cost you more now but will save you money in the long run.

It is hard to choose when there are so many health insurance providers out there, so always do your own research as to what each provider does and doesn’t cover you for and then make your choice based on your own wants and needs.

Consider –

- Your age – extra dental cover may be necessary as you get older

- The state of your dental health – some older people have great dental health and younger people have poor dental health, select your coverage based on what you need

- Your finances – those in a high-income bracket may find that extra coverage isn’t needed

- The economics of it all – though your dental health may be excellent, you should consider coverage based on the family member with the worst dental health or needs, children requiring braces etc….

- Look for any *freebies* the health fund is offering – this could be as simple as priority dental appointments which gives you preferential treatment when it comes to seeing a dentist – even if it is an unscheduled visit.

- Always read that *fine print* what are the annual limits? The lower the limit, the less benefits. Is there a waiting period? Some procedures have a waiting time of 2 months, while to undergo major dental procedures it could be a 12 month wait time. Are there any out-of-pocket expenses? Ask what the differences are between general and major dental procedures, even though you are paying, there will often be out of pocket expenses.